How to Set Up Taxes & Duties in Shopify

Welcome to our comprehensive beginner's guide on setting up taxes and duties in Shopify! As a new online store owner, navigating the world of taxes and duties can be daunting. But worry not - we've got you covered. In this easy-to-follow tutorial, we'll walk you through the process step-by-step to ensure your Shopify store is compliant with tax laws and offers a transparent shopping experience for your customers.

Master the art of configuring tax rates for different regions, enabling tax-inclusive pricing, and handling duties for international shipping with ease. Packed with valuable tips, detailed explanations, and best practices, this guide is perfect for Shopify newbies looking to create a seamless and compliant online store. So, let's dive in and get started on optimizing your store's tax and duty setup!

Set Up Taxes & Duties in Shopify

Access Your Shopify Store's Tax Settings

First things first, you need to access your Shopify store's tax settings.

To do this, simply follow these steps:

Log in to your Shopify admin account.

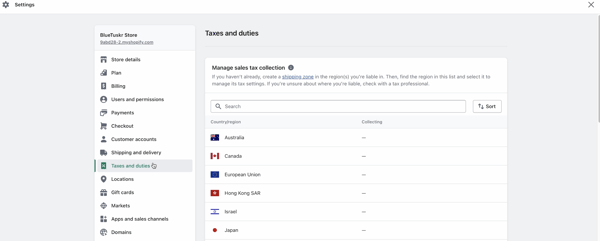

Click on "Settings" in the bottom left corner.

Select "Taxes" from the menu that appears.

Now you're in the right place to set up your taxes and duties.

Set Up Tax Rates

Now that you're in the "Taxes" section, you can set up your tax rates.

Here's how:

Under the "Tax Regions" tab, you'll see a list of countries and regions. Click on the country or region you want to configure.

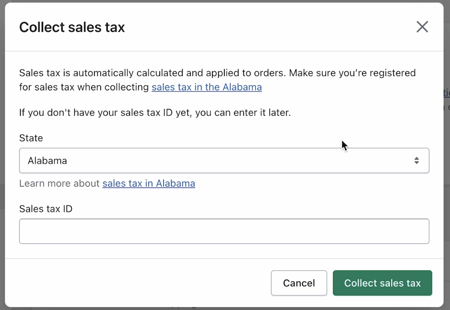

Then click the Start Collecting button.

You can add tax rates for each state. Just provide the Sales tax ID. If you're unsure about the rates, consult your local tax authority or a tax professional.

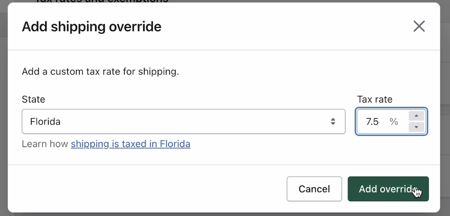

If necessary, you can override tax rates for shipping and specific products.

To do this, click "Override" next to the product category or Shipping and enter the new tax rate.

Once you've set up your tax rates, just exit it and it will automatically save your changes.

Enable Tax-Inclusive Pricing

Some countries require you to display prices with taxes included. To enable tax-inclusive pricing on your Shopify store, follow these steps:

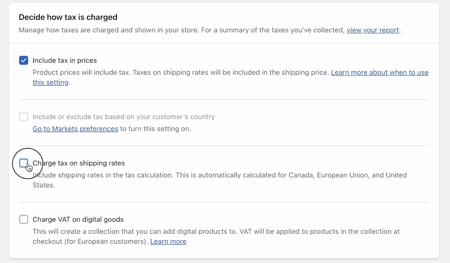

In the "Decide how tax is charged" section,

You have the option to Check the boxes for "Include tax in Prices", "Charge Tax on Shipping Rates", and "Charge Tax on Digital Goods".

Benefits

Setting up taxes and duties in Shopify comes with several benefits:

Compliance

Properly setting up taxes ensures your online store complies with local tax laws and regulations, helping you avoid fines and legal issues.

Transparency

Tax-inclusive pricing and calculating duties at checkout provide a transparent shopping experience for your customers, which can lead to increased trust and loyalty.

Streamlined Operations

By automating tax calculations and duty handling, you save time and effort, allowing you to focus on growing your business.

Conclusion

And there you have it, folks! We've walked you through the process of setting up taxes and duties in your Shopify store, step by step. Now you can be confident that your store is compliant with tax laws and provides a transparent shopping experience for your customers. Remember, if you're ever unsure about tax rates or regulations, it's always a good idea to consult with a tax professional or your local tax authority.

Happy selling, and see you in the next video!

How to Set Up Taxes & Duties in Shopify Summary

1. Log In to Your Shopify Admin

2. Navigate to Taxes and Duties

3. Set Up Tax Rates

4. Enable Tax-Inclusive Pricing

5. Review All of the Changes.

Interested in e-commerce strategy services? Contact our team at Bluetuskr, an e-commerce marketing agency.

Watch the Full Video Here:

Connect With Us

Recent Post

- Oct 28, 2023

- Author: Andrew Maff

Tips and Best Practices in Designing the Shopify Homepage

- Sep 12, 2023

- Author: Andrew Maff

How to Use Shopify AR & 3D Models to Boost Customer Engagement

.png)

Tell us what you think!